Estimated read time: 6-7 minutes

This archived news story is available only for your personal, non-commercial use. Information in the story may be outdated or superseded by additional information. Reading or replaying the story in its archived form does not constitute a republication of the story.

Gene Kennedy/AP Reporting Delta Air Lines announced this morning that it has formally rejected a hostile bid from US Airways.

This is good news for Utah's leaders, who hoped it would go this way.

The airline also filed a reorganization plan with the bankruptcy court today that calls for it to emerge from Chapter 11 in the spring of 2007 as a standalone company.

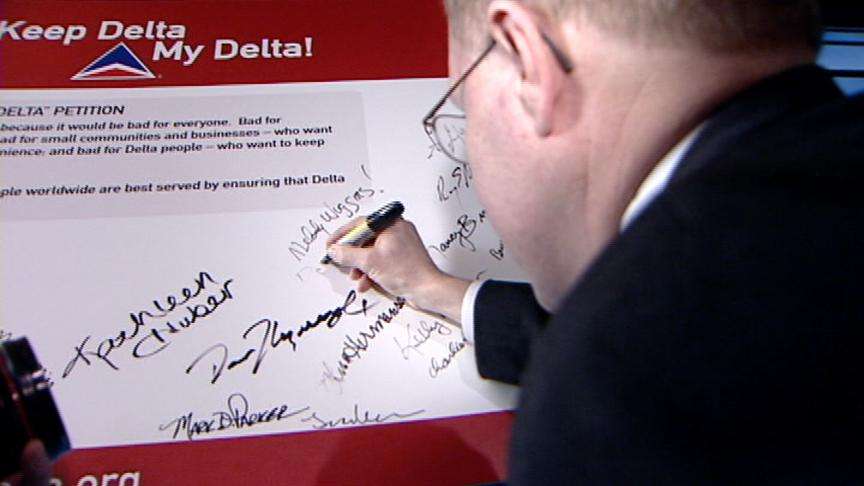

A rally in support of Delta was held at 11:00 this morning at the Salt Lake International Airport, called "Keep Delta My Delta." Viewers can sign an e-petition which opposes US Airways' takeover of Delta by logging on to the website provided in the Related Links section of our website.

The rally is one of nine events taking place at cities across the country.

Utah's Attorney General, Mark Shurtleff, was there.

Gene: You don't hear the phrase "hostile takeover" for a lot of mergers. What is different about this one?

Attorney General Mark Shurtleff: "Generally with a merger you'll have two airlines coming together, one from the east and one from the west saying if we merge our resources we can give better service to our people. This is not something Delta is reaching out for. This is not a friendly merger. This is something that US Airways sees an opportunity, because of the bankruptcy, to steal Delta away by paying less for it than what its worth. My concern as Attorney General is that this is a redundant merger of two airlines already providing service in the same area. If it happens, they can cut seats and flights, and ultimately make prices go up and give fewer options for Utah travelers. I have a responsibility to scrutinize this and, if in fact this violates anti-trust laws as being anti-consumer, then we have a responsibility to bring action and we are joining together with other Attorney Generals to investigate and perhaps bring action in this case."

Gene: Do you think that US Airways has done anything illegal?

Mark Shurtleff: "I'm not going to reach any conclusions right now and that's why I can't sign the petition. I have to take an impartial attitude right now, but we are aggressively investigating this. The Department of Justice has a responsibility to look at every merger, so do states. The D.O.J. may not do something, and the state of Utah has the authority to take a look at this and maybe prevent it from happening. If, in fact, it violates anti-trust laws and consumer protection laws, then we will have the ability to come in and stop it perhaps."

Others said to be in attendance were Senate President John Valentine and state representative Steve Sandstrom, who used to be a US Airways pilot. Other representatives were there as well, all in support of preventing a Delta-US Airways merger.

Salt Lake is Delta's western hub, and Utah officials fear a merger could jeopardize that status, that there could be a reduction in the number of flights, job losses, fare increases, and possibly fewer service options.

US Airways told Governor Huntsman last month that a merger would not affect Salt Lake's hub status, but our elected leaders are skeptical.

Senate Minority Leader Mike Dmitrich: "I think anything that would disrupt this hub in the state of Utah would be detrimental to all the citizens and to the people who travel to and from Salt Lake."

In its bankruptcy court filing, the Atlanta-based carrier outlined a five-year business plan, and said that its advisers have determined that a reorganized Delta will have a consolidated equity value of roughly $9.4 billion to $12 billion. It said the plan would result in a recovery by Delta's unsecured creditors of roughly 63 percent to 80 percent of their allowed claims.

Delta's existing stock would be wiped out under the plan and creditors generally will receive distributions of new Delta common stock to settle their claims.

Creditors must now vote on whether to approve Delta's reorganization plan or any competing plan that may be filed with the court. The plan also must be approved by the court.

In announcing that its board has unanimously rejected US Airways' unsolicited offer, Delta said, "The board concluded that Delta's standalone plan will provide the company's creditors with superior value and greater certainty on a much faster timetable than the US Airways proposal."

In a conference call with analysts, Delta's chief executive officer, Gerald Grinstein, put it bluntly: "US Airways is the worst of all potential merger partners."

There was no immediate comment by Tempe, Ariz.-based US Airways, but an official with knowledge of that company's plans who spoke on condition of anonymity because of the sensitivity of the talks said Monday that US Airways was willing to increase its offer if Delta could justify it is worth more.

But Delta said Tuesday that as far as it is concerned it believes flying solo is the best proposal for everyone involved.

"Their proposal is a bad deal for Delta and its creditors," Grinstein said of US Airways.

Delta said it believes the US Airways deal is not likely to gain regulatory approval. It also cited as obstacles: overwhelming labor issues and "flawed economic assumptions."

Delta's chief financial officer, Ed Bastian, said in a conference call with reporters Tuesday that Delta so far has not received buyout bids from any airline other than US Airways. He also said that Delta has "not been approached about any other merger proposals."

Bastian said Delta showed its reorganization plan to its creditors committee last week. He would not say how creditors specifically reacted, but he said he believes the committee will ultimately support Delta's plan. "I believe the creditors will at the right speed support the plan," Bastian said.

Delta said US Airways continues to experience significant integration problems with its prior, smaller deal with America West. It believes US Airways is not equipped to simultaneously integrate a substantially larger company like Delta.

Bastian also said that the government's pension insurer is expected to give the final go-ahead Wednesday to Delta terminating its pilots' pension plan. The termination would be effective Sept. 2 and would mean the Pension Benefit Guaranty Corp. would take over the pilot pension plan and pay retired pilots a benefit up to a certain limit.

On other issues, Bastian said Delta is evaluating key assets to see how to use them best to drive shareholder value. He did not elaborate. Delta also is continuing to cut domestic capacity and increase international capacity, Bastian said.

Delta said its business plan projects, among other things, a 50 percent reduction in net long-term debt and a return to profitability in 2007 and an increase in net income, after profit-sharing, from roughly $500 million next year to roughly $1.2 billion in 2010.

Delta filed for Chapter 11 in New York in September 2005.

Delta said its reorganization plan calls for rolling its bankruptcy financing of $2.1 billion into a new package that would go into effect when it emerges from Chapter 11, and it said it has received several proposals with competitive terms to help it do that.

Bastian said Tuesday that Delta was not disclosing the exact distribution method of resolving claims in the bankruptcy case. For now, he said Delta was proposing a stock distribution in the new company, but has not determined yet how much if any cash to distribute to creditors.

US Airways' offer included $4 billion in cash and 78.5 million shares of US Airways stock.

There has been no decision about who will lead Delta once it emerges from bankruptcy, Bastian said. Delta's current chief, Grinstein, has said he plans to leave Delta around the time it exits bankruptcy. Bastian said the decision about Grinstein's replacement would be made later.

(The Associated Press contributed to this report)