Estimated read time: 2-3 minutes

This archived news story is available only for your personal, non-commercial use. Information in the story may be outdated or superseded by additional information. Reading or replaying the story in its archived form does not constitute a republication of the story.

Associated Press

NEWARK, N.J. (AP) - The rap artist "Fat Joe" pleaded guilty Thursday to failing to pay taxes on nearly $3 million in income he earned over two years for performances and music royalties.

The platinum-selling artist, whose real name is Joseph Cartagena, was once a Billboard chart topper with hits like the duet "What's Luv" with the R&B singer Ashanti.

Cartagena entered the plea in federal court in Newark because some of the companies he earned money from are incorporated in New Jersey.

The 42-year-old Miami Beach, Fla., resident entered pleas to two counts covering years 2007 and 2008. His sentencing will take into consideration the government's initial allegation that he failed to pay income taxes for years 2007 through 2010. Federal prosecutors said the total tax loss to the government for those four years was $718,038.

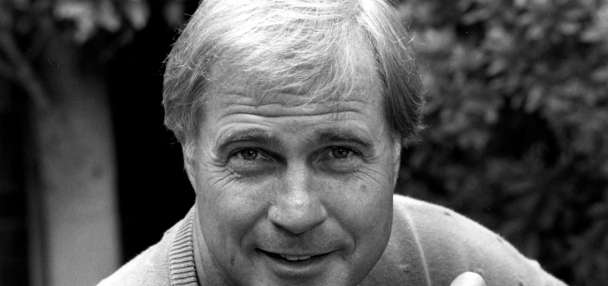

Wearing a navy suit, Cartagena looked fit and considerably slimmer than the former size that had earned him his rapper nickname. He has been very public about his efforts to shed weight after fellow rap stars died from obesity-related issues and was recently in Newark to speak to schoolchildren about health and fitness.

In federal court Thursday, when asked by U.S. Magistrate Cathy Waldor if he understood the charges he was facing, he replied, "I super-understand it."

Cartagena's lawyer, Jeffrey Lichtman, said outside federal court that his client "had already taken steps to resolve this situation" before he had been charged. He said the rapper hoped to pay back the taxes by the time of his sentencing April 3.

Cartagena owned the Somerville-based Terror Squad Production Inc. and Miramar Music Touring Inc., according to court papers. He also earned income from FJTS Corp., during the time in question.

The judge set bail at $250,000 and released Cartagena until his sentencing. He could face up to two years in prison and a fine of up to $200,000, plus penalties from the Internal Revenue Service.

___

Follow Samantha Henry at http://www.twitter.com/SamanthaHenry.

(Copyright 2012 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.)