Estimated read time: 4-5 minutes

This archived news story is available only for your personal, non-commercial use. Information in the story may be outdated or superseded by additional information. Reading or replaying the story in its archived form does not constitute a republication of the story.

SALT LAKE CITY — Her voice quavering due to age, 90-year-old Darlene Snow explained to a federal judge how she and her late husband lost their retirement savings to Curtis DeYoung.

Turning to look at the man dressed in a striped jail jumpsuit, Snow said she felt sad, "not for myself and certainly not for you, Curtis." Snow said she felt bad for his parents, calling DeYoung their "fair-haired boy."

"For two years we tried and tried to call you. Of course, you were always out. We needed our money. It wasn't a lot of money, but it was to keep me when he died. My husband put it right in Curtis' pocket," said Snow, whose husband, Dean, died of a heart attack in April.

Snow was among about 5,400 people whose retirement money — $25 million in all — DeYoung stole through his company, American Pension Services.

U.S. District Judge David Nuffer sentenced DeYoung to 10 years in prison Tuesday, though not nearly long enough for the victims who spoke in court. He also imposed five years of probation and barred him from investment advising when he gets out of prison.

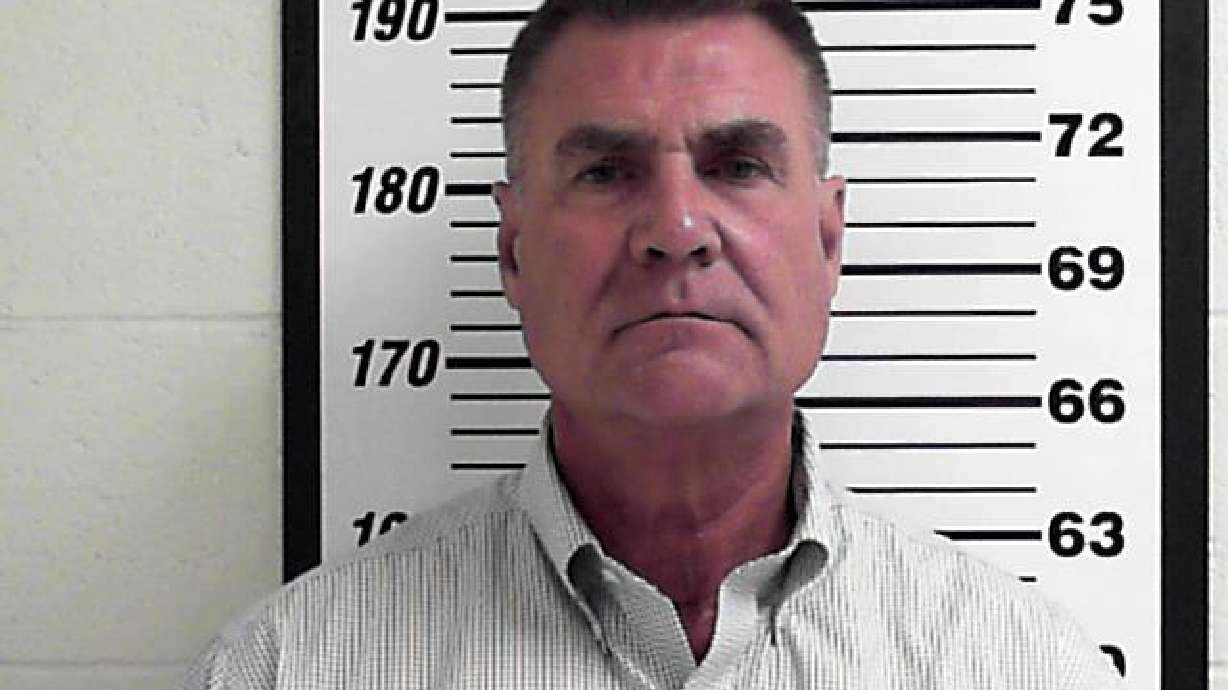

DeYoung, 60, earlier admitted to mail fraud and making a false declaration to a court in a plea deal. In exchange, prosecutors agreed to drop 16 other fraud and charges.

Nuffer called investment fraud an "epidemic" in Utah that leaves broken hearts and broken lives. He said there seems to be an "inexhaustible" supply of gullible victims and predators.

"It's a tragedy and a stain on our community," the judge said.

DeYoung declined Nuffer's invitation to speak during the hearing.

By all accounts, DeYoung was an upstanding member of the community, a husband and family man who ran a successful business. He appeared on CNBC as an expert in self-directed individual retirement accounts, which American Pension Service specialized in.

"People trusted him and they trusted him with a lot of money," said prosecutor Jacob Strain.

But he stole millions of dollars from roughly 5,400 people, the highest number of victims the U.S. Attorney's Office has seen for years in Utah.

"Mr. DeYoung was able to keep that secret all those years because he essentially cooked the books," Strain said.

DeYoung even tried to start a new business after the Securities and Exchange Commission sued him and his company and seized his assets. He also admitted to hiding gold, silver, diamonds and emeralds in a drop ceiling at a business where his ex-wife worked.

Harry and Denise Segura have known DeYoung for 36 years and were next-door neighbors in Draper for 24 years. They and their two grown children, both West Point graduates, lost thousands of dollars to him, as did Denise Segura's parents, Dean and Darlene Snow.

The Seguras' children wrote letters to the judge that their mother read in court.

"He knew me growing up. He knew me at church. He knew I was in the military. He watched my parents suffer the worry that accompanied a child deploying to an unstable war zone," wrote Holly Bryant, who invested her $25,000 military loan and combat and hazard duty pay with DeYoung.

"Knowing all this, he did not think twice about taking it all from me to use as his personal piggy bank."

Anthony Segura wrote that he and his wife won't be able to afford the mounting medical bills, mechanical wheelchair, surgeries and therapy for the 19-month-old daughter who suffers from a rare and terminal glycogen disorder.

"It wasn't just money the DeYoung family stole from my wife and I. They stole time we could have with our daughter — time that will already be cut too short," he wrote.

Harry Segura told the judge that his family trusted DeYoung take care of them and their money. "How wrong we were. He didn't help us at all. He helped himself to our life's savings," he said.

Segura said DeYoung should serve one day in prison for each victim, amounting to more than 15 years. He called the plea agreement "weak and lazy." He said if DeYoung didn't think it was a "great deal" for him, he wouldn't have agreed to it.

"All Curtis has to give us is time. Give us each our day," Segura said to the judge.

Nuffer required DeYoung to pay back the $25 million to investors. Strain said because the SEC was able to seize many of his assets, victims could get as much as 90 percent of their retirements back, though none has been returned so far.

Patricia Huff, a 66-year-old retiree, told the judge she doesn't expect to see any of her money again.

"I was paying for his greed," she said. "Now, it's his turn to pay for his greed."