Estimated read time: 2-3 minutes

This archived news story is available only for your personal, non-commercial use. Information in the story may be outdated or superseded by additional information. Reading or replaying the story in its archived form does not constitute a republication of the story.

SALT LAKE CITY — Gary Lassen had been perfectly comfortable investing his 401K in the stock market. Until 9-11 happened.

After a six-day shutdown, the New York Stock Exchange posted the biggest losses in its history to that date and Lassen lost confidence in the market.

So in 2008, when the market tanked again, the Salt Lake City man bailed.

"When it started to go down and hit really heavy, I pulled out," he said.

He put his funds in money market funds. After two crashes in a decade, many Americans have lost faith in the market and pulled out and not gone back.

Stocks a tough sell

A dozen years ago, according to the Federal Reserve, the average US household had just over half of its assets in stocks and stock funds. Last year, that percentage dropped to about 38.

Financial planner Ray LeVitre said these days, stocks are a tougher sell.

Carl Richards, a financial planner, author and New York Times blogger who writes about financial behavior, said people have a natural tendency to take the recent past and project it indefinitely into the future — something behavioral economists call recency bias.

"We take these small sample sizes and we project them into the future," Richard said.

Behavior costs people money

According to an analysis by Fidelity, people who pulled out of the market the end of 2008 to the beginning of 2009 and stayed out for two or three years, got a 2 percent return on their money. Investors who stayed in made 50 percent.

"Are we gonna rely on the weight of evidence, of history, which says these things go up and down and over the long haul it goes up," Richards said. "Basically what it says is we are investing in the concept of capitalism."

Returning to the market

After a few months, Lassen visited financial planner Ray LeVitre.

Lassen needed to do something, LeVitre said, but he didn't know what to do.

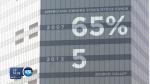

LeVitre told him that, historically, seven out of 10 years, the market goes up.

"The risk to not being in the market or not staying in the market is probably greater than the risk of being in the market," LeVitre said.

Recently there have been signs that people are returning to the market. Last month, during which the Dow Jones Industrial Average topped 14,000, investors poured $55 billion into US equity funds, the most for any month on record, according to TrimTabs Investment Research.

Lassen, luckily, got back in about the time the market bottomed out and benefited from those huge gains. Now, approaching retirement age, Lassen said he's comfortable having his money in stock funds.

"So if you look at it over the long haul, over the long run, it's foolish to, in my opinion completely get out of stocks," he said. "It doesn't make any sense.

"The trend is always up and has been forever, if you just bide your time and wait," he said. "That provided a lot of peace, a lot of peace of mind."