Estimated read time: 1-2 minutes

This archived news story is available only for your personal, non-commercial use. Information in the story may be outdated or superseded by additional information. Reading or replaying the story in its archived form does not constitute a republication of the story.

NEW YORK CITY — The number of Americans who can't afford to pay off their credit cards is on the rise as emergency savings continue to drop, according to a new survey.

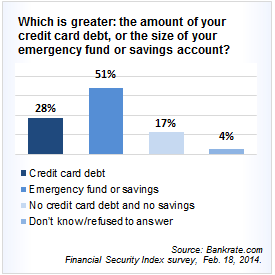

Just more than half of Americans, 51 percent, reported having more emergency savings than credit card debt in a survey by Bankrate.com released Tuesday. The institution said it was the lowest percentage it has seen since it began tracking the topic in 2011.

"This is a reflection of the stagnant incomes, long-term unemployment and high household expenses that are hampering the financial progress of many Americans," said Bankrate.com analyst Greg McBride in a statement.

Twenty-eight percent of participants said they have more credit card debt than emergency savings and 17 percent said they had neither credit card debt nor emergency savings.

People who were employed full-time were more likely to say they had high levels of credit card debt, with 36 percent reporting they had more debt than savings. Twenty-four percent of part-time workers and 21 percent of unemployed participants had more credit card debt than savings.

Retirees and college graduates were the most likely people to have savings — 64 percent of people who were retired and 62 percent of college graduates had more savings than credit card debt.

The group with the greatest amount of debt was people between the ages of 30 and 64.

Thirty-six percent of participants said they feel less comfortable with the amount of money they have saved compared to a year ago.

"The stock market's rocky start to the year and a run of less-than-stellar economic readings have put a dent in consumers' feelings of financial security," McBride said.